How do you measure your online store’s success? Do you typically focus on things like sales and revenue?

While these metrics are useful for tracking the short-term performance of content and campaigns, they don’t always paint a complete picture of your business’ future. Even looking at your current sales numbers can sometimes leave you with just a fleeting glimpse of your true financial situation.

Customer Lifetime Value (CLV) is one of the most important factors in determining your business’ present and future success. It’s an often-overlooked metric that can accurately predict how much your customers are really worth. By measuring the net profit that you’ll take in over the course of your entire relationship with a customer, you’ll be able to narrow down exactly how valuable they are to your business.

CLV gives you crucial insight into how much money you should be spending on acquiring your customers by telling you how much value they’ll bring to your business in the long run. Rather than just racing to keep your head above water, you’ll be able to understand which customers you should be focusing on and, more importantly, why you should be focusing on them.

Why is Customer Lifetime Value important?

Customer Lifetime Value is a clear look at the benefit of acquiring and keeping any given customer.

Not all customers are created equal. In fact, the top 1% of ecommerce customers are worth up to 18 times more than average customers.

As a business owner, you need to be able to focus your efforts on acquiring the right customers—the customers who will take your business from being a flash-in-the-pan success to a household name.

While CLV is incredibly useful, it’s traditionally very difficult to calculate. If you’ve tried to uncover your CLV in the past, you’ve probably found yourself knee-deep in complicated algorithms and formulas.

Thankfully, there are much simpler ways to calculate your CLV, but don’t let the simplicity fool you— the complexity of other formulas isn’t without good reason. Customer behaviors are very difficult to predict and can seem completely random at a glance which makes CLV an inherently complex measure to track.

Just think about it. Some of your customers might make small purchases every week, others might make big purchases once a year—and there all sorts of combinations in between. How can you possibly predict how much your next customer will actually contribute to your business?

CLV takes some of the mystery out of knowing how your current and future customers will behave. By calculating your CLV, you’ll be able to understand how often certain types of customers will make purchases and when those same customers will stop making purchases for good.

Although there are some more advanced methods for forecasting CLV out there, the strategy that we’ll be covering in this post is a straightforward way for you to get the information you need to refine your approach to customer acquisition.

With this simplified approach to Customer Lifetime Value, you’ll easily be able to take a snapshot of your customers’ purchasing history and flip it into a widescreen forecast of their future actions.

Segmenting your customers with RFM

Before we dive into Customer Lifetime Value, let’s take a look at the foundational elements of analyzing customer value: Recency, Frequency, and Monetary Value (RFM).

RFM is a technique for organizing your customers from least valuable to most valuable by taking into account the following factors:

- Recency refers to the last time that a customer made a purchase. A customer who has made a purchase recently is more likely to make a repeat purchase than a customer who hasn’t made a purchase in a long time.

- Frequency refers to how many times a customer has made a purchase within a given time frame. A customer who makes purchases often is more likely to continue to come back than a customer who rarely makes purchases.

- Monetary Value refers to the amount of money a customer has spent within that same time frame. A customer who makes larger purchases is more likely to return than a customer who spends less.

By segmenting your customers with RFM, you’ll be able to analyze each group individually and determine which set of customers has the highest CLV.

To use RFM to organize your customers, you’ll need to grab three pieces of data about every individual customer: The date of their most recent transaction, the number of transactions they’ve made within a consistent timeframe (a year will work best), and the total amount that they’ve spent during that same timeframe.

If you own a Shopify store, you’ll be able to find all of this data in the Reports section of your Admin.

Head to Reports and click Sales by Customer Name. You'll be able to find data like order count and total sales for every customer here.

For RFM calculations, each of these variables needs to given a scale. The simplest way is to use a scale of 1 to 3. This might seem a bit confusing, but don’t worry, it’s not as complicated as it looks. Remember: This scale is just a way to help you visualize which groups of customers are most valuable.

You’ll be assigning your customer’s recency, frequency, and monetary value each a value on your scale of 1 to 3. Think of these three values as categories: 1 being the least valuable, 2 being somewhat valuable, and 3 being the most valuable.

So, when you sort your data, your least valuable ⅓ of customers will get assigned a score of 1, the ⅓ above that will get a 2, and so on.

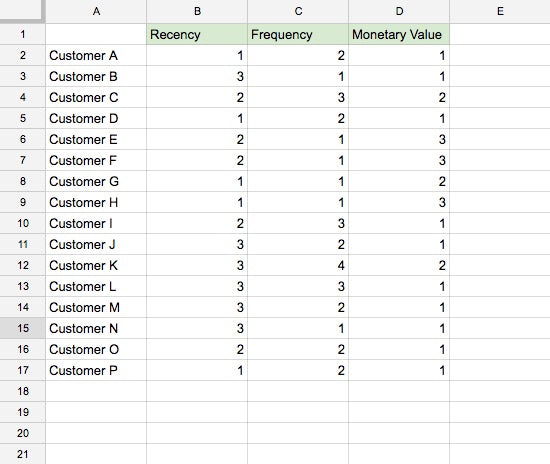

To help you get a better idea of how this might work, let’s take a look at an example spreadsheet.

For this spreadsheet, I’ve already collected my customers’ information and broken down each variable into three categories based on my data. To do this, I’ve taken the range of data for each variable and divided it into three equal segments.

As an example, for Recency, customers who have made a purchase within the last four months are given a 3. Customers who have made a purchase within the last four to eight months are given a 2. And customers who have made a purchase within the last eight to twelve months are given a 1.

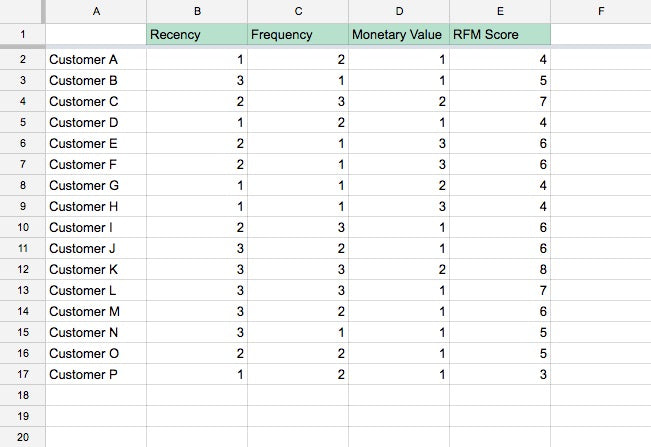

Now, we’ll add up the score for each customer and list a total under RFM Score.

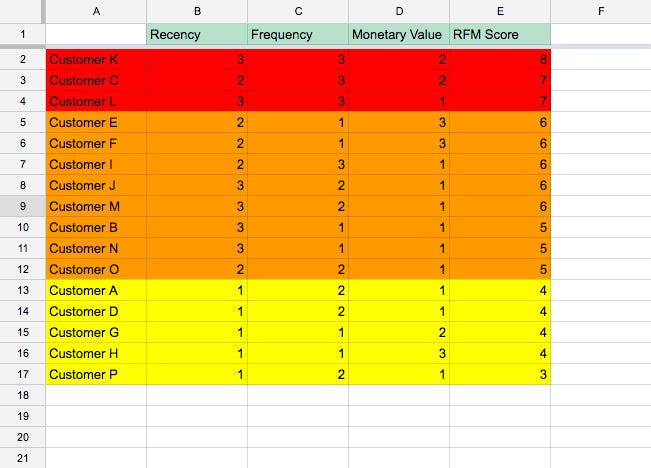

Finally, sort your chart by RFM Score and divide your results by highest (shown here in red), middle (orange), and lowest score (yellow).

Your highest scoring results will be your most valuable customer segment—be sure to dive into the data to try and find common threads between these customers that could indicate why they provide more value and how you can target them better.

How to calculate Customer Lifetime Value

Now that you've segmented your customers with RFM, it's time to determine the value of each segment to see which of your customers perform the best.

To calculate the Customer Lifetime Value for each of your customer segments, you’ll need to track down three key pieces of data within your pre-established timeframe: Average Order Value, Purchase Frequency, and Customer Value.

Average Order Value

Average Order Value represents the average amount of money that a customer spends every time they place an order. To get this number, you’ll simply need to take your total revenue and divide it by your total number of orders.

If you own a Shopify store, you can find this information by heading to the Reports section of your Admin and taking a look at your Sales by Month. You’ll just need to divide your Total Sales by your Order Count for the past year.

Note: To get a more accurate number, be sure to click Define under Total Sales and uncheck everything except for Subtotal.

Average Order Value = Total Sales / Order Count

Purchase frequency

Purchase frequency represents the average amount of orders placed by each customer. Using the same timeframe as your Average Order Value calculations, you’ll need to divide your total number of orders by your total number of unique customers. The result will be your Purchase Frequency.

Shopify store owners can also find this data in their Reports under Sales by Customer.

Purchase Frequency = Total Orders / Total Customers

Customer value

Customer value represents the average monetary value that each customer brings to your business during a timeframe. To calculate your Customer Value, you’ll just need to multiply your Average Order Value by your Purchase Frequency.

Customer Value = Average Order Value x Purchase Frequency

Free Reading List: Conversion Optimization for Beginners

Turn more website visitors into customers by getting a crash course in conversion optimization. Access our free, curated list of high-impact articles below.

Get our Conversion Optimization reading list delivered right to your inbox.

Almost there: please enter your email below to gain instant access.

We'll also send you updates on new educational guides and success stories from the Shopify newsletter. We hate SPAM and promise to keep your email address safe.

Calculating your Customer Lifetime Value

Now that you have the Customer Value for each segment of your customer base, calculating the CLV is as simple as taking your Customer Value and multiplying it by the average customer lifespan.

Your average customer lifespan is the length of time that your relationship with a customer typically lasts before they become inactive and stop making purchases permanently.

When it comes to customer lifespan, it’s important to understand the difference between being a contractual and non-contractual business.

Most online stores are non-contractual, meaning that once a purchase is made, the transaction is effectively over. The difficulty with these types of businesses is in identifying when an active customer (someone who makes purchases and will continue to make purchases) becomes an inactive customer (someone who will never make a purchase from your business again).

However, some online stores, like subscription box-based businesses, fall into the contractual category. With a contractual business, you know exactly when a customer becomes inactive because they announce it when they end their contract or subscription. With a contractual business, it’s much easier to identify your average customer lifespan.

If your store is brand new or has only been around for a few years, you might not have access to enough data to determine the average lifespan length of your customers. But don’t worry—there’s a quick way to work around this and still get some actionable results from your calculations.

For newer stores, a lifespan of three years will work fine as a rough estimate. This will give you a good idea of how customers will potentially perform within the immediate future (as well as give you some added incentive to keep them around).

Increasing your Customer Lifetime Value

While your calculations may have given you some results to get excited about, there’s always room for improvement! Here are some quick tips for getting the most out of every customer relationship by creating new opportunities to increase their value:

Encourage your customers to spend more

A key part of increasing your customers’ lifetime value is encouraging them to spend more on each order, boosting your overall average order value.

Pricing plays a huge psychological role in how much customers spend and what customers choose to purchase. Here are some ideas that might improve your pricing model:

- English speakers read from left to right. If you’re selling expensive items, focus on making the left digit as low as possible to trick the mind into perceiving the price as smaller than it actually is. As an example, $199 seems a lot less expensive than $200.

- Comparison pricing helps make decisions for customers. Do you offer multiple models of the same product? Line them up and contrast the strengths of each model to justify the price point and help your customers pull the trigger quicker.

- Social proof is a powerful thing. Try incorporating an Instagram feed into your product pages with apps like Like2HaveIt and Shoppable Instagram to show off how other customers are using your products. Not only will your customers feel inspired, but they’ll also be more inclined to hit “Add to Cart”.

- Scarcity means exclusivity. The more exclusive something seems, the more valuable it is in the minds of your audience. Encourage your customers to act now and place larger orders by setting up sales with fixed deadlines.

- Free shipping discounts create larger carts. If you offer free shipping, consider setting your discount threshold higher. Depending on your business (and the average price of your products), this could mean $50, $100, or even higher. If your customers typically come close to hitting the threshold, they’ll easily be able to justify tossing an extra item in their cart to get free shipping.

Keep your customers coming back more often

For better CLV, it’s important to not just keep your customers coming back, but to keep them coming back frequently and for longer amounts of time.

Here are some easy ways to improve your customer frequency and lifespan by giving your customers some incentive to pay you a visit more often:

- Turn receiving a package into an event. The key to keeping your customers surprised, delighted, and coming back for more is a memorable unboxing experience. Put some extra love and care into how you ship your products with free gifts, personalized notes, and fun packaging.

- Newsletters are your secret weapon. Email marketing is a fantastic tool for any business. Keep customers in the loop on product restocks, upcoming sales, and exclusive deals with a well-curated, beautifully designed newsletter.

- Engage with your fans on social media. Platforms like Facebook, Twitter, and Instagram are perfect for reaching out and connecting with your audience. Stay at the top of your customers’ minds with an engaging and fun social media presence.

- Loyalty programs keep customers around. Use a loyalty program to show your most dedicated customers that you care by offering them gifts and rewards for repeat purchases.

- Consider subscriptions to hook customers. Do you offer a product that customers need to buy regularly like coffee beans or socks? Think about setting up a subscription program to lock in repeat business. It’s easier for you and your customers.

Shopify Academy Course: Ecommerce Email Marketing 101

Ecommerce expert Drew Sanocki shares his method for launching automated email marketing campaigns that build relationships and make sales.

Enroll for freePutting your Customer Lifetime Value to work

With your Customer Lifetime Value in hand, you’ll now be able to start building smarter, more efficient campaigns by optimizing your spending and fine-tuning your targeting.

One of the primary uses for CLV is to help you keep your Cost Per Acquisition as low as possible.

If you don’t know how much you’re spending to acquire new customers, all you need to do is divide your total marketing/sales budget for a specific timeframe by the amount of new customers you gained in that same timeframe. The resulting number will be the average amount that you spend every time your business acquires a new customer.

The difference between your Customer Lifetime Value and your Cost Per Acquisition is your Return On Investment, or ROI. That’s the amount of money you get out of a customer relationship after you’ve deducted the money that you spent to kickstart the relationship in the first place. To stay profitable, you’ll need to maximize your ROI.

Additionally, if you know your CLV, you’ll also be able to figure out how much you can afford to spend on paid ad campaigns on Google and Facebook.

To determine how much you should be putting into campaigns, you’ll first need to know your conversion rate.

For instance, if your Customer Lifetime Value is $100 and the conversion rate for one of your marketing campaigns is 10%, then your maximum bid for that campaign should be 10% of $100. So, in this scenario, you’d be able to bid a maximum of $10 per click without blowing your budget.

Find the right customers for your business

Success isn’t about finding customers—it’s about finding the right customers. Now that you can calculate the lifetime value of your current customer base, you’ll be able to start crafting campaigns that target and win over those customers that really make the difference for your bottom line.